Posting and Reversing a Revenue Adjustment

To post a revenue adjustment, enter the claim number in the search field and then click the claim number in the search results.

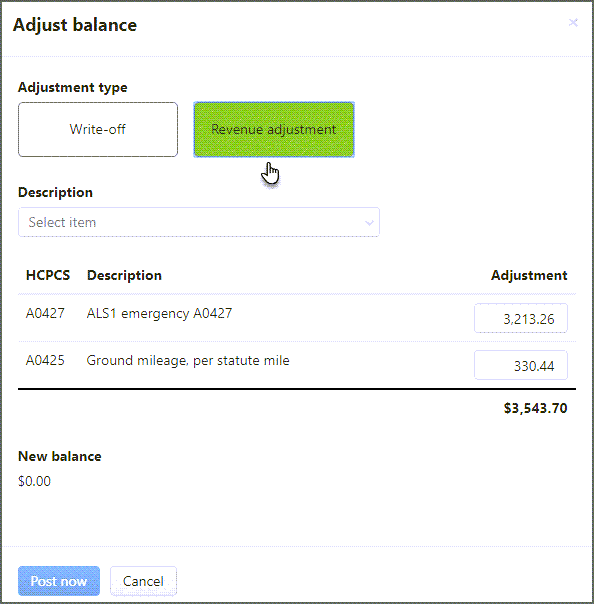

- On the Claim page, click the Credits tab and then the Adjust balance button.

- When the "Adjust balance" window opens, click Revenue adjustment, click the Description field and choose a description from the list, and then enter the adjustment amount for each HCPCS.

- The new balance will display at the bottom of the window. Click Post now.

You can view the revenue adjustment in the Credits, Running Claim Balance, and Running Charge Balance tabs on the Claim page.

Revenue adjustment description list

The following are the revenue adjustments available when you click the Description field in the "Adjust Balance" window.

|

|

Reversing a revenue adjustment

If you applied the revenue adjustment by mistake, don’t worry. You can easily reverse the adjustment.

-

First, let’s get back to the Claim page by entering the claim number in the search field and clicking the claim number in the search results.

-

On the Claim page, click the Running claim balance tab. On the top right side of the credit block containing the revenue adjustment information, click the Reverse adjustment link.

-

On the confirmation window, click Reverse adjustment.

You will note that both the original revenue adjustment and the reverse write-off displays in the credit block.